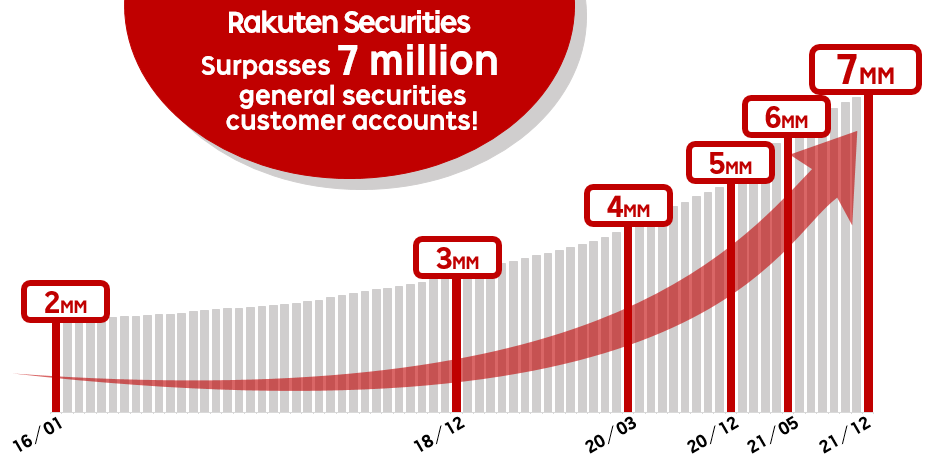

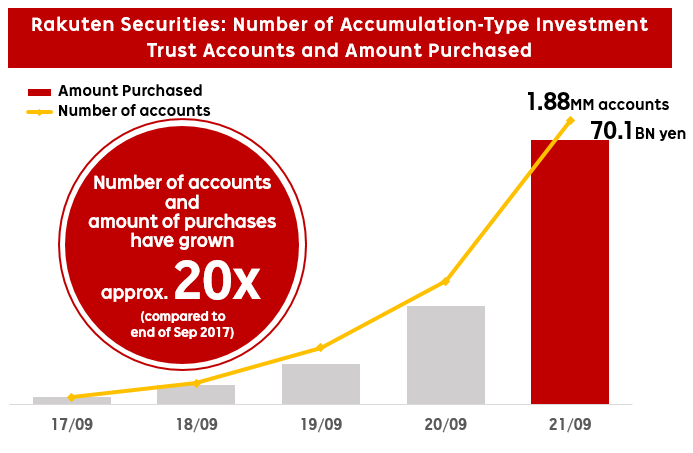

Tokyo, December 7, 2021 – Rakuten Securities, Inc. today announced that its general securities accounts have reached the seven million mark. The company also announced that 1.88 million customers are making regular monthly savings deposits to investment trusts totaling more than 70 billion yen per month as of the end of September 2021, representing a nearly 20-fold increase since the end of September 2017. To commemorate the seven million customer account milestone, Rakuten Securities is offering the chance to win original Okaimono Panda goods through a lucky draw giveaway campaign.

- Rakuten Securities, Inc.

Rakuten Securities General Securities Customer Accounts Reach Seven Million Mark

Since launching in 1999 as the first dedicated online brokerage service in Japan, Rakuten Securities has worked to continually expand and enhance its lineup of services with retail investors top of mind.

Rakuten Securities provides intuitive trading tools for stock trading and other related services ranging from the iSPEED® series to cutting-edge stock-trading tools like MARKETSPEED® II that make trading possible on all platforms, not only personal computers. Rakuten Securities is also the first major online securities firm in Japan to introduce logins with image-based two-factor authentication, and continues to work to enhance security features while providing a safe and intuitive trading experience for investors.

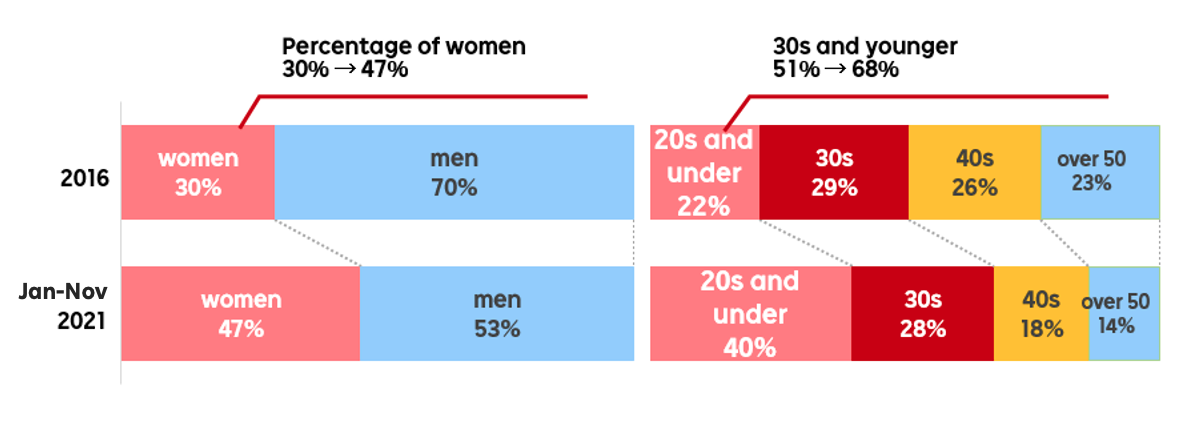

As part of the Rakuten Group, Rakuten Securities has leveraged synergies within the Rakuten Ecosystem in recent years to expand its lineup of services that are also accessible to investment newcomers, such as Point Investment, allowing customers to use Rakuten Points to invest in investment trusts (regular and installment purchases) and purchase domestic stocks. Making credit card payments with a Rakuten Card also allows users to make regular purchases of investment trusts while earning points, without the need for advance deposits. As a result of these efforts, Rakuten Securities became the industry leader in new account openings for the third year running in 2020*1. With the expansion of asset building services, the percentage of customers opening new Rakuten Securities accounts in the under-40 demographic rose from 51% in 2016 to 68% in the five-year period culminating at the end of November 2021.

As a clear indicator that many investors are using Rakuten Securities for asset building, the number of customers making regular monthly savings deposits for investment trusts rose to 1.88 million as of the end of September 2021, a year-on-year (YoY) increase of 122.5%, while the amount of purchases increased 162.5% YoY to a monthly total of more than 70 billion yen.

The achievement of the seven million account milestone is made possible by the invaluable support of our customers. As an expression of customer appreciation, Rakuten Securities is holding a lucky draw giveaway campaign featuring original Okaimono Panda-themed prizes. Details will be announced soon on the Rakuten Securities website.

Rakuten Securities will continue working to be the asset-building platform of choice for customers ranging from investment newcomers to seasoned traders, expanding its array of services to meet their diverse investment needs.

-

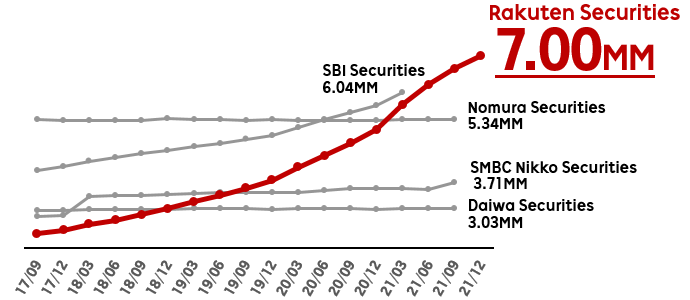

Number of general securities customer accounts by brokerage*2

-

Evolving demographics of Rakuten Securities account holders: Increase in female and young customers

-

20x increase in the number of accumulation-type investment trust customers and amount purchased

*1 Comparison of major online brokers. Top five by number of accounts (in alphabetical order): au Kabucom Securities, Matsui Securities, Monex Securities, Rakuten Securities and SBI Securities. As of December 7, 2021. Source: Rakuten Securities research.

*2 Aggregated by Rakuten Securities from information publicly available on the website of each company, using accounts with balance (Nomura Securities, Daiwa Securities) and total number of accounts (SMBC Nikko Securities). As SBI Securities does not disclose the number of non-consolidated accounts, the number of accounts as of the end of March 2021 was used.

Explanation of fees, etc. and risk

When investing in a Rakuten Securities product, certain fees and charges may be associated. Customers may also bear losses due to the fluctuating market value of the product(s). Regarding fees, etc. and risk associated with investing in product(s), customers should carefully read the page detailing the fees, etc. and risk associated with investment on the Rakuten Securities website and the pre-contract documents in order to ensure full understanding.

Trade name: Rakuten Securities, Inc. (Rakuten Securities website)

Financial Instruments Business Operator: Kanto Local Finance Bureau (FIBO) No. 195, commodity futures trader

Trade associations: Japan Securities Dealers Association, Financial Futures Association of Japan, Commodity Futures Association of Japan, Type II Financial Instruments Firms Association, Japan Investment Advisers Association

About Rakuten Securities

Rakuten Securities, Inc. launched in March of 1999. In addition to providing innovative comprehensive financial brokerage services, including the trading platforms MARKETSPEED® and iSPEED®, Rakuten Securities consistently strives to lower investment hurdles for retail investors by leveraging the Rakuten Ecosystem, including services such as Point Investment and Rakuten Card.