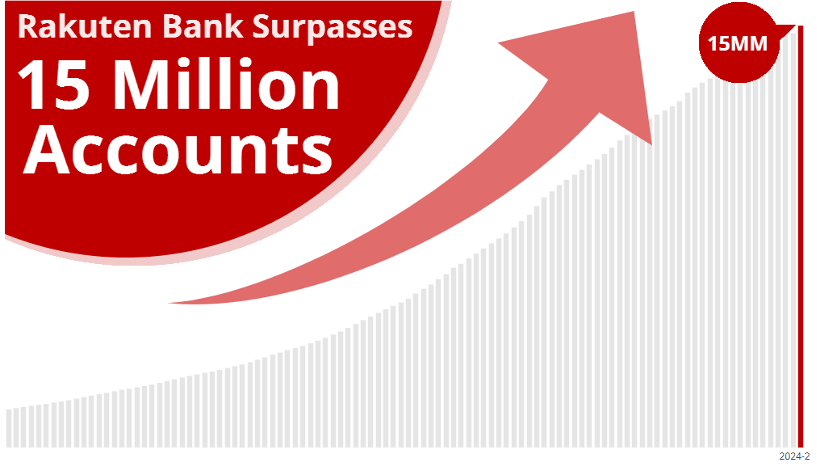

Tokyo, February 13, 2024 - Rakuten Bank, Ltd. today announced that it has surpassed 15 million customer accounts as of February 11, 2024*1.

- Rakuten Bank, Ltd.

Rakuten Bank Surpasses 15 Million Customer Accounts

Since it started as a digital bank in 2001, Rakuten Bank has been committed to providing convenient services to individual, corporate and sole proprietor business customers. The number of Rakuten Bank accounts has now surpassed 15 million, and the bank recently achieved the milestone of 10 trillion yen in total balance of non-consolidated deposits at the end of December 2023. Rakuten Bank customers are using multiple services after opening their accounts, such as bank transfers and using their accounts to receive salaries and bonuses. As a result, the use of Rakuten Bank as a main account is steadily expanding*2.

Rakuten Bank aims to provide customers with greater convenience and value not only through the bank’s services but also by strengthening collaborations with other Rakuten Group services. In addition to offering the convenience of easy accessibility 24 hours a day, 365 days a year*3, the handy Rakuten Bank app serves as a one-stop shop for almost all of the bank’s services.

Rakuten Bank provides a number of convenient services for customers, including awarding Rakuten Points – Japan’s highest-rated point program*4 – for making money transfers and using their account to receive their salary and bonuses, and the Happy Program, a loyalty program which waives ATM fees up to seven times per month and bank transfer fees up to three times per month by linking the customer’s Rakuten ID with their Rakuten Bank account. Other services include Money Bridge, which offers preferential interest rates on ordinary deposit accounts up to 100 times higher than other major banks*5, when users link their Rakuten Bank account with their Rakuten Securities account, the Rakuten Pay App, which allows customers to directly debit their Rakuten Bank account, and a payment feature on the Rakuten Pay app that awards users with Rakuten Points for making purchases directly through their Rakuten Bank account.

As the bank continues to leverage these strong synergies with the Rakuten Ecosystem, the growth in Rakuten Bank's customer accounts has also been driven by Rakuten Securities’ increasing customer base, with customers attracted by the convenience of using both Rakuten Securities and Rakuten Bank together. The new NISA (Nippon Individual Savings Account) program, introduced in January 2024, and shift to zero commission trading for Japanese stocks has boosted growth in Rakuten Securities, which surpassed 10 million general securities customer accounts in December 2023.

These initiatives have been well-received by individual, corporate and sole proprietor business customers, leading to the latest milestone of 15 million Rakuten Bank accounts. Going forward, Rakuten Bank will continue working to offer innovative and convenient products and services to customers.

*1 Excludes closed accounts.

*2 Accounts used for account transfers or for receiving salary/bonus.

*3 Excludes maintenance periods.

*4 Online survey on points, 1000 valid responses, conducted by MyVoice Communications, Inc. in November 2022.

*5 As of February 13, 2024. Research by Rakuten Bank.

About the Happy Program (Customer Loyalty Program)

The Happy Program is a customer loyalty program under Rakuten Bank. Entry is free and users are awarded Rakuten Points for signing up with the program and for each transaction. Accumulated points can be used to pay for bank transfer fees and debit card usage charges. Users enjoy benefits every time they move to a higher membership tier and are eligible for ATM fee waivers up to seven times per month and bank transfer fee waivers up to three times per month.

For more information visit: https://www.rakuten-bank.co.jp/happyprogram/

About Money Bridge

A preferential interest rate of 0.10% per annum (0.079% after tax)* is applied on ordinary deposit accounts for users who apply for Money Bridge. When there are insufficient funds for transactions on Rakuten Securities, funds are automatically deposited from the user’s Rakuten Bank account balance. In addition, funds in the securities account can be automatically deposited into the Rakuten Bank account during the evening after each business day. This “sweep” function saves users the trouble of transferring funds manually and allows them to enjoy preferential interest rates.

For more information visit:

https://www.rakuten-bank.co.jp/assets/intermediation/moneybridge/

*There is a cap to the balance for which the preferential interest rate of 0.10% per annum (pretax) can be applied when users apply for Money Bridge. For balances of 3 million yen and below in ordinary deposit accounts: 0.10% per annum (0.079% per annum after tax). For balances exceeding 3 million yen in ordinary deposit accounts: 0.04 per annum (0.031% per annum after tax)

About the Rakuten Bank App

The Rakuten Bank App allows users to conduct almost all banking transactions, including opening an account, checking balances and transactions, as well as making bank transfers and depositing money in term deposits and foreign currency deposits, on their mobile phones.

For more information on transaction details available on the Rakuten Bank App visit https://www.rakuten-bank.co.jp/lp/app/