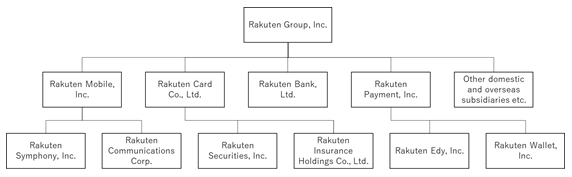

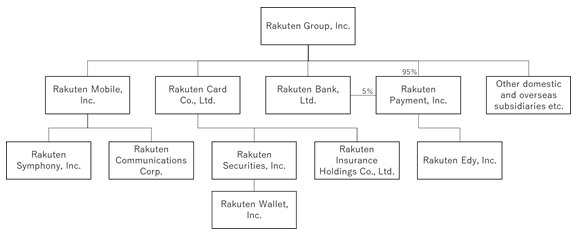

At the Board of Directors meeting today, Rakuten Group, Inc., (hereinafter “the Company”) decided that with an effective date of July 1, 2022 (expected), Rakuten Bank, Ltd. (hereinafter “Rakuten Bank”), a consolidated subsidiary of the Company, will acquire shares of Rakuten Payment, Inc. (hereinafter “Rakuten Payment”), also a consolidated subsidiary of the Company, through a company split (hereinafter “company split”). By transferring the shares, the parent company of Rakuten Wallet, Inc. (hereinafter “Rakuten Wallet”), another consolidated subsidiary of the Company, will change from Rakuten Payment to Rakuten Securities, Inc. (hereinafter “Rakuten Securities:”), also a consolidated subsidiary of the Company, through a share transfer (hereinafter “share transfer”).

Since this absorption split corresponds to a simplified absorption split to which the provision of Article 784, Paragraph 2 of the Companies Act applies, the disclosure of certain items and details has been omitted from this announcement.

1. Purpose of the organizational restructuring

Rakuten Bank, as reported in “Announcement Regarding Start of Preparation for Initial Public Offering of Rakuten Bank, Ltd.” dated September 30, 2021, is preparing for listing to enable various growth including independent financing and execution of financial strategies, etc.

Rakuten Bank, ahead of the proposed listing and considering its growth strategy, believes that bank accounts have started to become a primary point of contact for the settlement of payments for various purchasing activities of consumers, especially under the recent trend toward a cashless society. We believe it is indispensable for Rakuten Bank to collaborate with the cashless payment business, which will lead to customer acquisition, etc., in terms of being able to offer lifestyle accounts with a wide range of banking services and, by extension, further attract customers to the Rakuten ecosystem. On this occasion, we have decided to acquire shares of Rakuten Payment, which has one of the best customer bases in Japan. We believe that this acquisition of shares will lead to further expansion of Rakuten Bank's customer base and strengthening of its growth strategy, as well as contributing to the enhancement of the Rakuten Group's corporate value.

Regarding Rakuten Wallet, at the time of organizational restructuring in April 2019, from the perspective of incorporating crypto assets as part of the various payment methods provided by the Rakuten Group, it was put under the umbrella of Rakuten Payment. In May 2020 it became registered as a Type 1 Financial Instruments business based on the Financial Instruments and Exchange Act. We worked to strengthen the margin trading business, and under the umbrella of Rakuten Securities, for the purpose of pursuing synergies based on business affinity with Rakuten Securities, which is also a Type 1 Financial Instruments company, governance and compliance systems were strengthened.

Regarding the listing of Rakuten Bank's shares and related acts including the above, approval from the relevant authorities may be a prerequisite, and depending on the results of the examination during the preparatory process, the Rakuten Group may be further reorganized, and we may come to the conclusion that Rakuten Bank should not go public. Therefore, the scheduled listing date has not yet been decided at this time, but we will disclose it as necessary based on the progress.