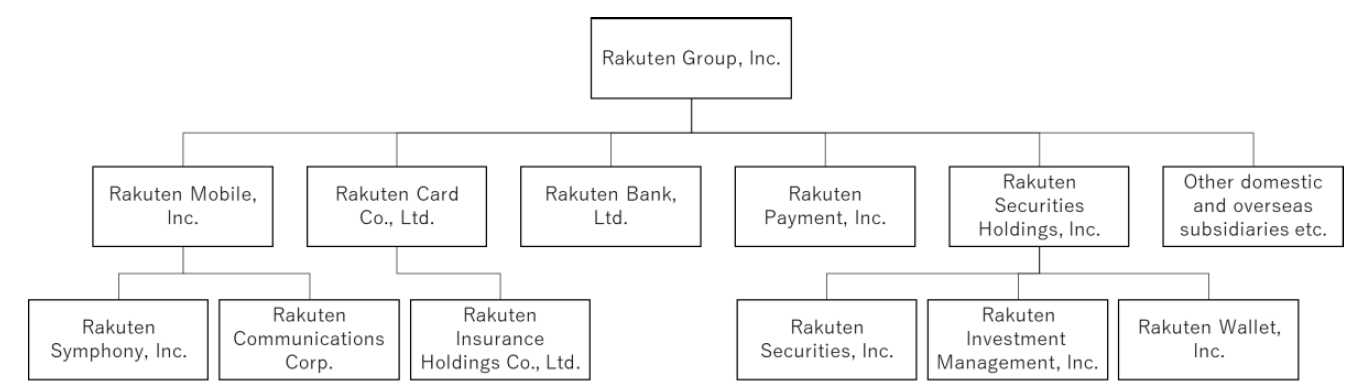

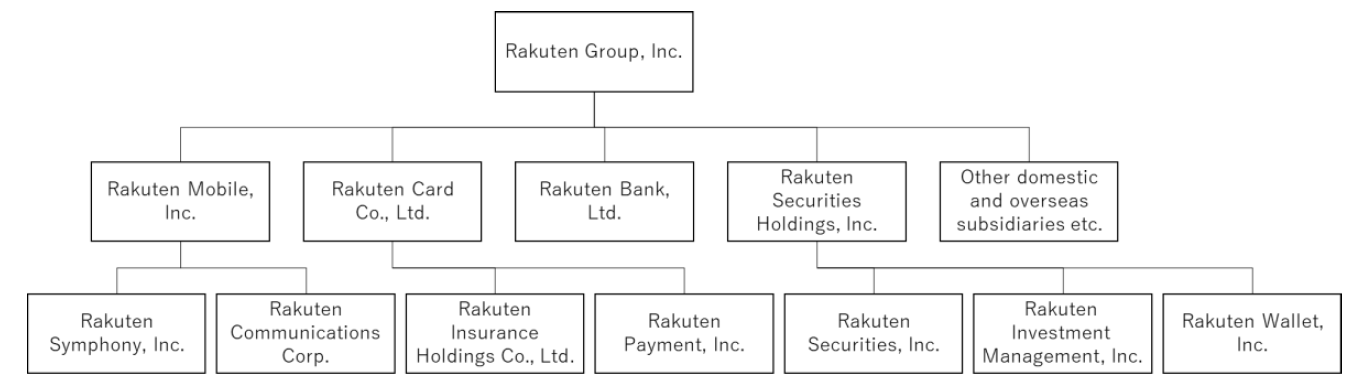

At the Board of Directors meeting today, Rakuten Group, Inc., (hereinafter “the Company”) decided that with an effective date of November 1, 2023, Rakuten Pay (online payments) business and Rakuten Point (online) business will undergo a company split, and our consolidated subsidiary Rakuten Payment, Inc. (hereinafter "Rakuten Payment") will be the successor company (hereinafter "Company Split").

In addition, with an effective date of November 1, 2023, all shares of Rakuten Payment held by the Company (95.28% of the total number of issued shares of Rakuten Payment), through share delivery (hereinafter “Share Delivery”) will be transferred to Rakuten Card Co., Ltd. (hereinafter "Rakuten Card"), also a consolidated subsidiary of the Company.

Purpose of the reorganization

As the mission of the Rakuten Group (“the Group”) continues to be “empowerment of people and society through innovation,” both in Japan and overseas, through more than 70 services in a wide range of businesses including internet services such as e-commerce, travel, and digital content; FinTech (financial) services such as credit cards, banking, securities, insurance, electronic money, and payment through mobile apps; mobile services such as the mobile carrier business; and professional sports, by organically linking these services based on a membership system centered around Rakuten members, we have formed the unique “Rakuten ecosystem.” By creating an environment where members in Japan and overseas can easily browse and access multiple services, we aim to leverage Group synergies to maximize the lifetime value of ach member and minimize customer acquisition costs, thereby maximizing Group profit.

The Company offers a wide range of products and services in the field of cashless payments that transcend online and offline barriers. Through our Rakuten Payment (online payments) business and Rakuten Point (online) business, we have increased the number of online transactions by providing a simple online payment service and a point service on the e-commerce sites of our partner companies. Rakuten Card plays a pioneering role in Japan in terms of both gross transaction value and the number of users of credit card payments, which are used in various purchasing behaviors in an environment where cashless society is progressing. In addition, Rakuten Payment covers offline payment needs in a multifaceted manner through Rakuten Pay (app payments), Rakuten Edy, and Rakuten Point Card, etc.

The payment business, which has multifaceted touchpoints with customers, is very significant in the sense of attracting customers for various services developed by the Rakuten Group and guiding them to the Rakuten ecosystem. In this regard, Rakuten Pay (online payments) business and Rakuten Point (online) business will be consolidated into Rakuten Payment. Rakuten Card, which is one of the largest in gross shopping transaction value and by customer base in Japan, and Rakuten Payment, which has one of the best customer bases in Japan and various cashless payment protocols, will work together to promote the business, hence we decided on this reorganization because we believe that we can further improve synergies within the Rakuten Group. We believe that this reorganization will lead to the expansion of the Rakuten Group's customer base and the strengthening of our growth strategy, which in turn will contribute to the enhancement of corporate value.

In addition, by further strengthening the cooperative framework between Rakuten Card and Rakuten Payment, we believe that it will be possible to formulate strategies from a broad perspective for expanding the Rakuten ecosystem. Going forward, Rakuten Card, which will be the driving force behind the integrated payment business, will flexibly consider forming strategic partnerships with third parties and raising its own capital as necessary.