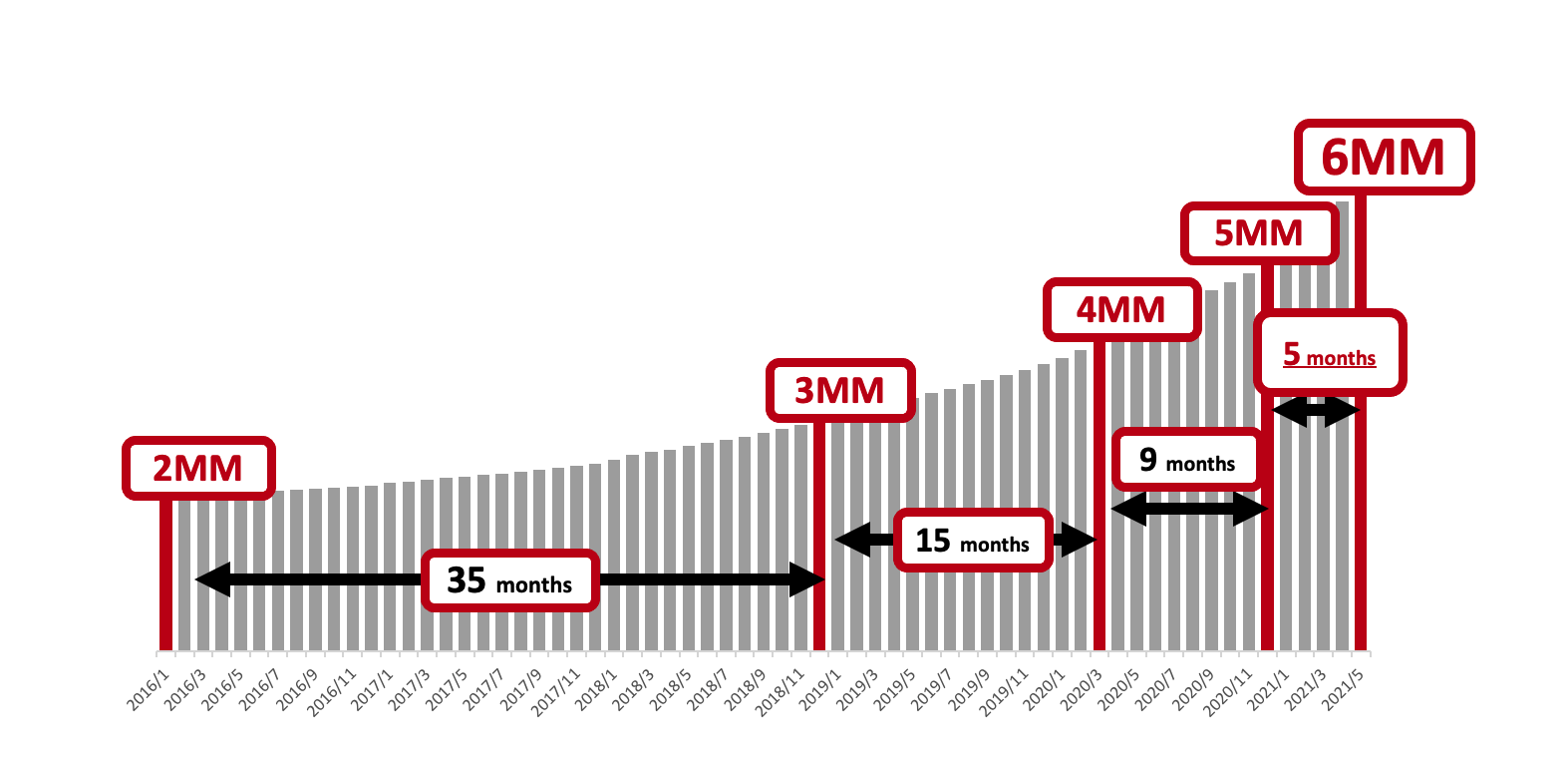

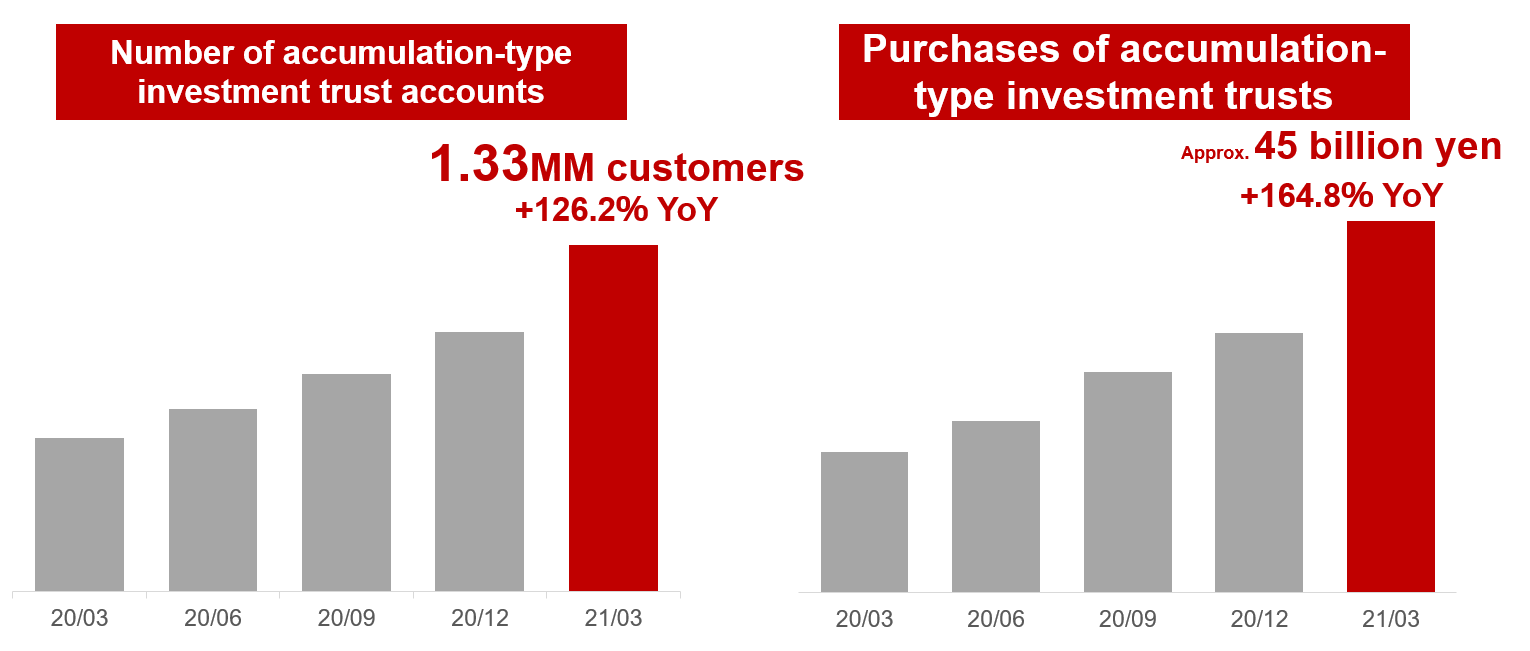

Tokyo, May 19, 2021- Rakuten Securities, Inc. today announced it has reached six million general securities accounts. After surpassing five million accounts in December 2020 with the addition of a million accounts opened over an approximately nine-month span, growth has continued to accelerate. Rakuten Securities reached an additional one million accounts in approximately five months, the fastest milestone to date. Additionally, for monthly saving investment trusts, 1.33 million customers were making regular monthly savings deposits to investment trusts totaling approximately 45 billion yen, up +164.8% year-on-year (YoY), as of the end of March 2021. To commemorate the latest six million account milestone, Rakuten Securities is offering the chance to win a share of six million Rakuten Points, as well as original merchandise from Vissel Kobe, Rakuten Eagles and more through a lucky draw giveaway campaign.

- Rakuten Securities, Inc.

Rakuten Securities Reaches Six Million General Securities Accounts

Since launching in 1999 as the first dedicated online brokerage service in Japan, Rakuten Securities has worked to continually expand and enhance its lineup of services with retail investors top of mind.

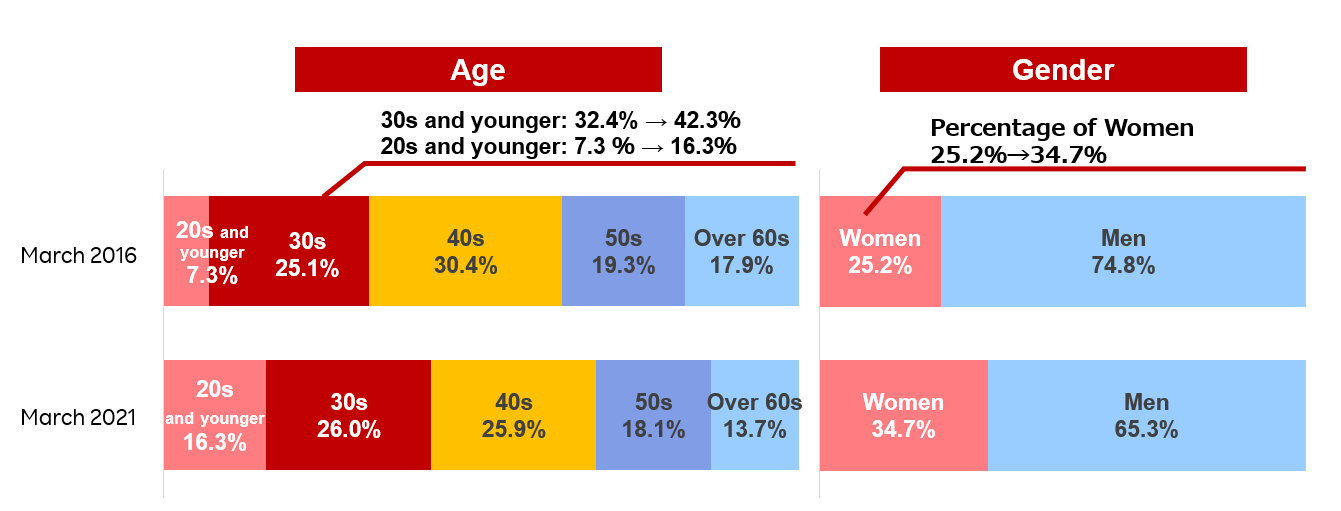

As part of the Rakuten Group, in recent years Rakuten Securities has leveraged synergies within the Rakuten Ecosystem to provide a service that is accessible to first-time investors, and in 2020 Rakuten Securities achieved the largest number of new account openings in the industry for the third year running*1. In particular, the appeal of Rakuten Points has won over customers through services such as Point Investment, which allows customers to use Rakuten Points to invest in investment trusts (regular and installment contributions), domestic stocks and binary option trading, as well as incentives such as offering 1% points back for Rakuten Card holders on contributions to installment investment trusts. As a result, the overall proportion of Rakuten Securities account holders in the under-40 demographic rose over the past five years from 32.4% at the end of March 2016 to 42.3% as of the end of March 2021. In addition, as of the end March 2021, 1.33 million customers are purchasing monthly savings for investment trusts, with the amount of contributions increasing +164.8% YoY to a monthly total of approximately 45 billion yen, indicating that, among the demographic interested in asset building, a large contingent are making use of Rakuten Securities.

Moreover, Rakuten Securities provides intuitive trading tools for stock trading and other related services ranging from the iSPEED® series to cutting-edge stock-trading tools like MARKETSPEED® II that make trading possible on all platforms, all while working to strengthen security features, realize the elimination of handling fees and provide an intuitive trading platform for investors.

As an expression of gratitude to the customers without whom the six million account milestone could never have been achieved, Rakuten Securities is holding a lucky draw giveaway campaign starting on May 24.

Prizes are as follows:

Prize A: A grand total of six million Rakuten Points - 1,000 points to be awarded to 6,000 winners

Prize B: Original Vissel Kobe merchandise - 150 winners

Prize C: Original Rakuten Eagles merchandise - 150 winners

Customers who have yet to open a Rakuten Securities account will receive 200 points for opening a new account during the campaign period. Campaign details such as dates and entry instructions will be available on the Rakuten Securities website soon.

-

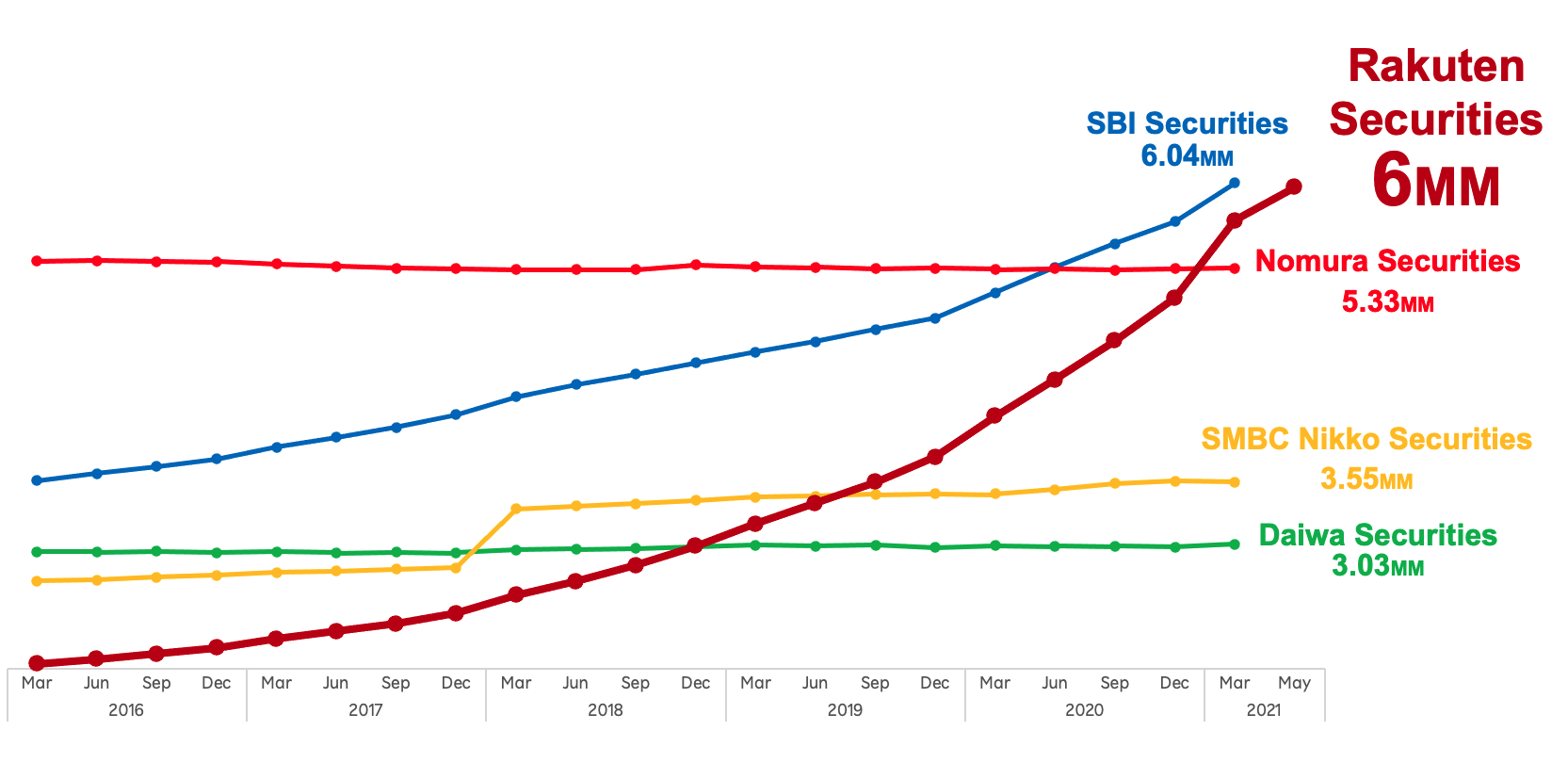

Number of general securities accounts by brokerage*2

-

Evolving demographics of Rakuten Securities account holders

-

Trends in the number of accumulation-type investment trust accounts and purchases of accumulation-type investment trusts

*1 Comparison of major online brokers. Top five by number of accounts (in alphabetical order): au Kabucom Securities, Matsui Securities, Monex Securities, Rakuten Securities and SBI Securities. As of May 19, 2021. Source: Rakuten Securities research.

*2 Aggregated by Rakuten Securities from information publicly available on the website of each company, using accounts with balance (Nomura Securities, Daiwa Securities) and total number of accounts (SMBC Nikko Securities).

Explanation of fees, etc. and risk

When investing in a Rakuten Securities product, certain fees and charges may be associated. Customers may also bear losses due to the fluctuating market value of the product(s). Regarding fees, etc. and risk associated with investing in product(s), customers should carefully read the page detailing the fees, etc. and risk associated with investment on the Rakuten Securities website and the pre-contract documents in order to ensure full understanding.

Trade name: Rakuten Securities, Inc. (Rakuten Securities website)

Financial Instruments Business Operator: Kanto Local Finance Bureau (FIBO) No. 195, commodity futures trader

Trade associations: Japan Securities Dealers Association, Financial Futures Association of Japan, Commodity Futures Association of Japan, Type II Financial Instruments Firms Association, Japan Investment Advisers Association

About Rakuten Securities

Rakuten Securities, Inc. launched in March of 1999. In addition to providing innovative comprehensive financial brokerage services, including the trading platforms MARKETSPEED and iSPEED, Rakuten Securities consistently strives to lower investment hurdles for individual investors by leveraging aspects of the Rakuten Ecosystem, such as Point Investment and Rakuten Card.