- Purpose and Reason for Offering

As the Rakuten Group’s mission continues to be “empowerment of people and society through innovation”, both in Japan and overseas, through businesses ranging from Internet services such as e-commerce, travel, and digital content to FinTech (financial) services such as credit card, banking, securities, electronic payment, mobile services such as the mobile carrier business and professional sports, we are leveraging technology through more than 70 services to contribute to users and local communities. By organically linking these services based on membership centered on Rakuten members, we have formed a unique “Rakuten Ecosystem” that cannot be found anywhere else. By creating an environment where members in Japan and overseas can easily browse and access multiple services, we are able to leverage Group synergies to maximize the lifetime value of each member and minimize customer acquisition costs, thereby maximizing Group profit.

In recent times, as “new lifestyles” emerge and evolve, e-commerce is playing an increasingly important role as basic infrastructure for living. Businesses that operate retail stores such as supermarkets are also required to provide services that are more convenient for users, not only providing services online, but also transcending the boundaries between online and offline (real stores) and driving a retail revolution in which consumption and marketing are changing dramatically. In addition to this, the provision of stable logistics services has become a pressing issue, as the increase in delivery volume due to e-commerce growth has resulted in multiple redeliveries and labor shortages, while the needs of parcel senders and receivers continue to diversify. To further strengthen our e-commerce business and to respond to these broader issues impacting society, we are actively collaborating and making alliances with strategic partners like Japan Post Co., Ltd. (Headquarters: 2-3-1 Otemachi, Chiyoda-ku, Tokyo. Representative: Kazuhide Kinugawa, hereinafter “Japan Post”), and Walmart Inc. (Headquarters: Arkansas, USA, Representative: C. Douglas McMillon. hereinafter “Walmart”).

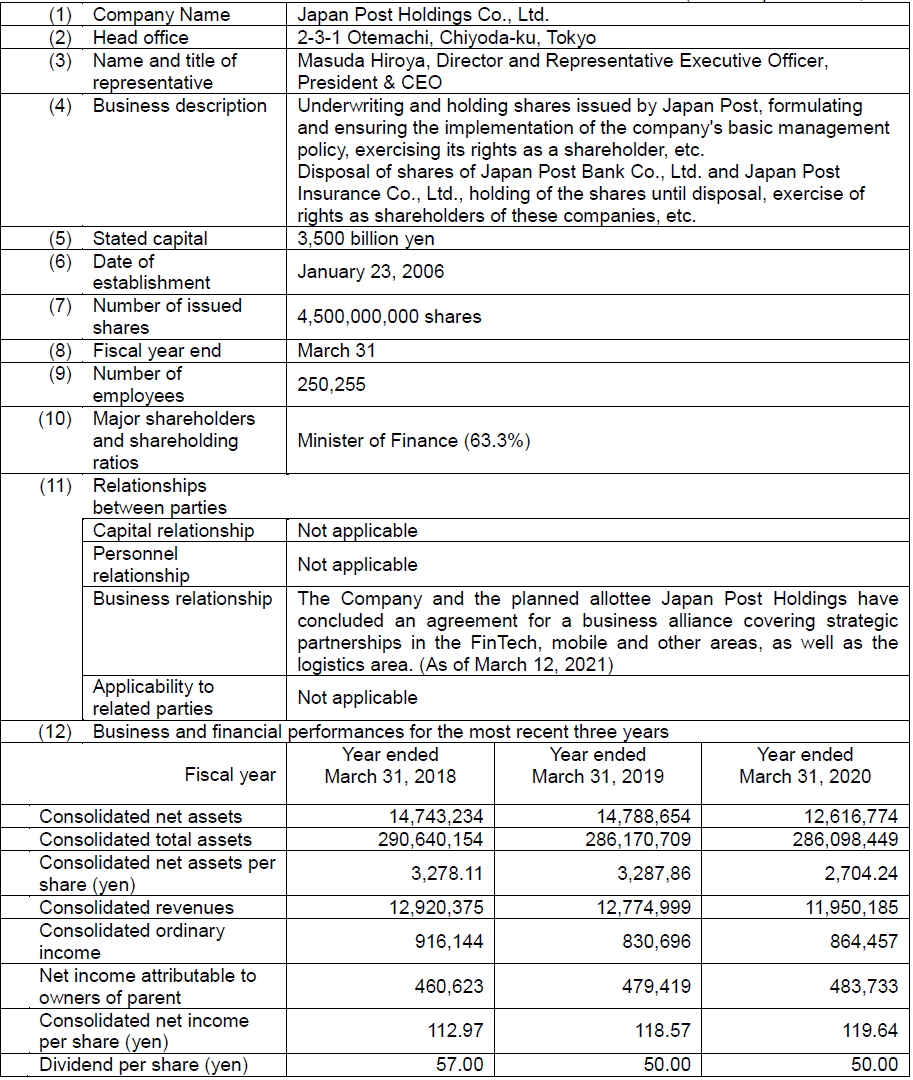

In April 2017, the Company and Japan Post, a consolidated subsidiary of Japan Post Holdings Co., Ltd. (Headquarters: 2-3-1 Otemachi, Chiyoda-ku, Tokyo. President: Masuda Hiroya, hereinafter “Japan Post Holdings”), announced a strengthening of our collaboration in e-commerce logistics to improve the efficiency of deliveries and reduce the ballooning of redeliveries. In January 2018, we launched a service that allows customers to pick up products purchased through the “Rakuten Ichiba” marketplace at post offices nationwide and Japan Post's home delivery lockers “Hakoposu”. In December 2020, the Company and Japan Post announced the signing of a Memorandum of Understanding to aim to form a strategic partnership to realize a robust and sustainable logistics environment. This partnership envisions data sharing and leveraging each other’s significant assets and knowhow, including Japan Post’s nationwide distribution network with its enormous delivery volume and data, and Rakuten’s expertise in demand forecasting and logistics operational know-how of order data as developed through “Rakuten Ichiba”. In this way, we will promote the creation of a new logistics platform designed to meet the needs of all stakeholders, including companies sending packages, consumers receiving packages, and workers in the logistics industry.

In addition to collaboration on deliveries from fulfillment centers operated by the Company, known as “RFC (Rakuten Fulfillment Center)”, the Company and Japan Post have collaborated on multiple fronts, including initiatives to reduce redelivery and special delivery rates for merchants on the “Rakuten Ichiba” marketplace. By strengthening cooperation through this alliance and building a new logistics digital transformation (“DX”) platform, the two companies also aim to encourage other e-commerce and logistics companies to participate in the platform, thereby contributing to the improvement of the logistics environment in Japan and to the realization of a sustainable society.

With this background, in addition to aiming to enhance logistics services through collaboration with the Japan Post Holdings Group (Japan Post Holdings and its affiliated companies; the same shall apply hereinafter), with its nationwide distribution network and huge delivery volume and data, the Company also sees significant potential to drive competitiveness and momentum through strengthening its relationship with the Japan Post Holdings Group in order to consider further alliances in FinTech, mobile consumer marketing, base station deployment and other fields. This is the background to our conclusion of a business alliance on March 12, 2021, between the Company, Japan Post Holdings, and its subsidiary Japan Post, as well as the Third-Party Allotment with Japan Post Holdings.

Hiroya Masuda, President, Japan Post Holdings, commented, “From the perspective of our Group strengths across a physical network of post offices nationwide and a robust logistics system, the cutting-edge digital technology and deep knowhow leveraged by the Rakuten Group in a diverse business portfolio of Internet services position them as an ideal partner. This alliance will further strengthen the relationship between our two groups, and going forward, we very much look forward to driving the momentum of our collaborations not only in logistics, but also mobile, digital transformation and a wide range of fields.”

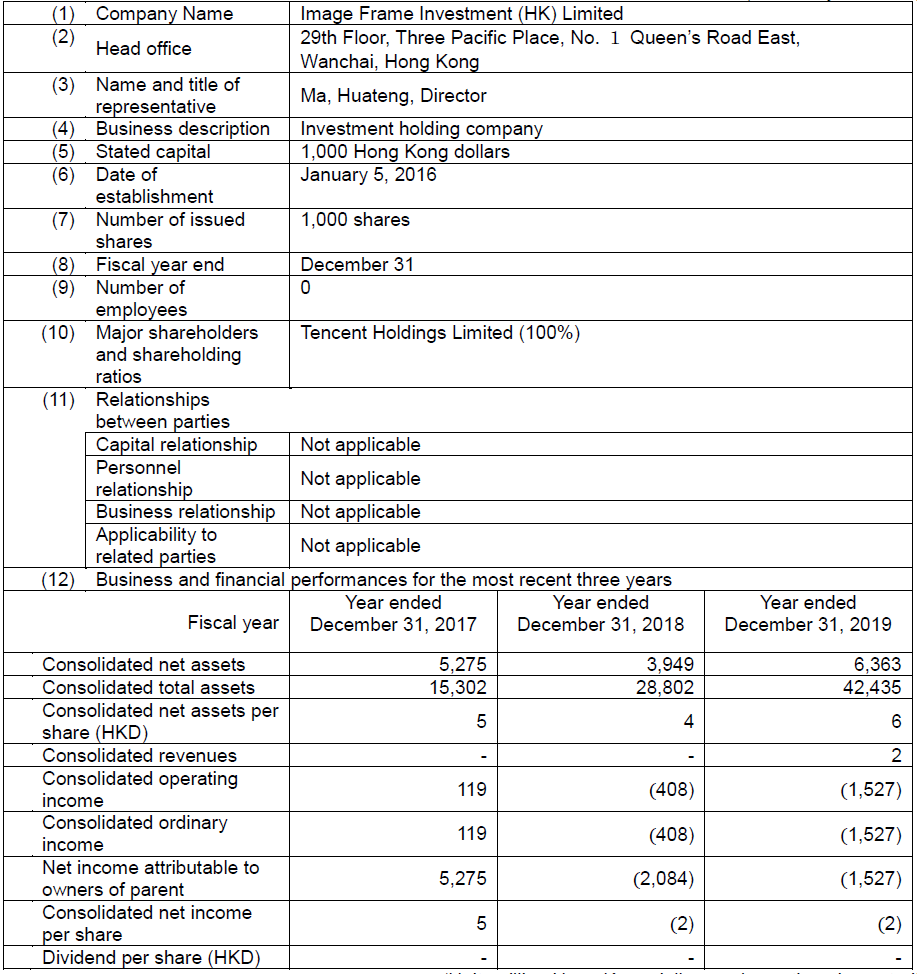

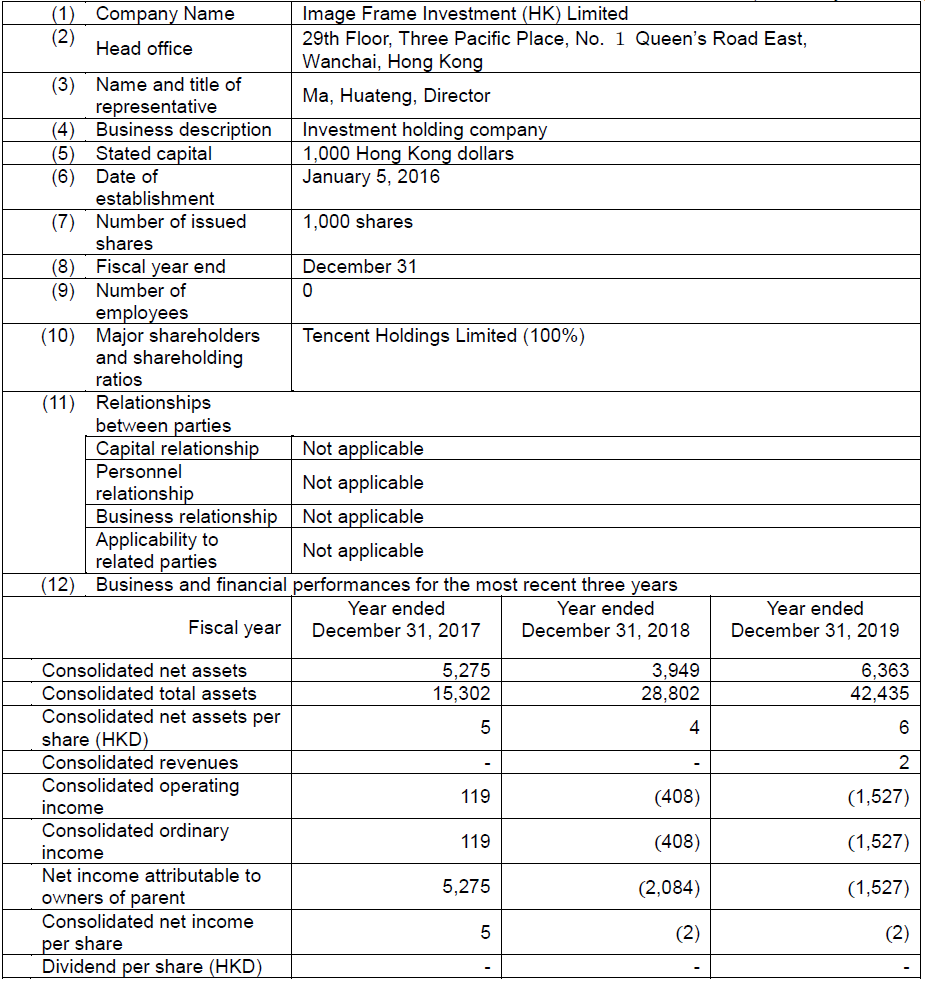

Tencent Holdings Limited (Headquarters: Shenzhen, China, Representative: Ma, Huateng), hereinafter “Tencent”, the parent company of Image Frame Investment (HK) Limited (Registration address: Hong Kong, Representative: Ma, Huateng), hereinafter “Image Frame Investment”. Tencent and Rakuten have been in contact with each other for many years, especially on matters related to Internet development trends. From the beginning of 2021, the Tencent Group (Tencent and its affiliated companies; the same shall apply hereinafter), had discussions with the Company regarding the subscription of the Company's shares. The Tencent Group is a global Internet company that provides communication, social, games, digital content, advertising, FinTech and cloud services. The Tencent Group operates the leading communication and social platforms in China, including Weixin and QQ. As globalization in the Internet and technology industries accelerates, we determined that strengthening our relationship with a leader in advanced technology such as the Tencent Group, with the aim of enhancing services through collaboration, has the potential to contribute to the competitiveness and momentum of the Rakuten Group. Potential areas for collaboration include digital entertainment and e-commerce. This is the background to our agreement to make the Third-Party Allotment to Tencent Group. According to guidance from Tencent, Tencent generally makes investments in other companies via investment holding companies; Image Frame Investment is an investment holding company that is 100% owned by Tencent, and they believe it is appropriate for this company to hold the Company's shares.

Martin Lau, Executive Director and President, Tencent Holdings, commented, “Rakuten has built a vibrant ecosystem through its membership and loyalty program, extending its unrivalled strength from e-commerce to FinTech and digital content. Tencent shares Rakuten’s aspiration of creating value through innovation and empowerment for users and partners. We are excited to invest in Rakuten, supporting its evolution into a global innovation leader. We look forward to pursuing strategic cooperation across activities including digital entertainment and e-commerce, creating value for users and building the Internet ecosystem together.”

In January 2018, the Company and Walmart announced a strategic alliance with the aim of expanding reach to users and improving services by leveraging the strengths of both companies in Japan and the United States. Since October 2018, we have seen significant and steady growth of the online grocery business “Rakuten Seiyu Net Super” that has been jointly operated through a joint venture of Seiyu owned only by the Company and the Walmart Group (Walmart and its affiliates; the same shall apply hereinafter) due to its wide range of products, sufficient delivery capacity to meet customer needs, and the strength of cooperation with Rakuten IDs. We are also collaborating to provide ebook service support in the United States with the “Rakuten Kobo” service. In addition, as part of the Company’s drive to utilize the more than 100 million Rakuten members in Japan and technology owned by the Rakuten Group to support DX of Japanese retailers including Seiyu, in March 2021, the Company completed acquisition of a 20% stake in Seiyu through the newly established Rakuten DX Solutions, Inc. At the same time, the KKR Group (KKR & Co. Inc. and its affiliates; the same shall apply hereinafter) also completed acquisition of a 65% stake in Seiyu, and the Walmart Group continues to hold a 15% stake in Seiyu. By combining the strengths of the Rakuten Group, Walmart Group, and KKR Group, we will utilize various know-how in Online Merges with Offline (OMO) measures and data marketing, etc., to utilize DX in retailers of food and daily necessities nationwide and aim to evolve the format for physical stores.

*In addition, to be precise, 100% of the Seiyu shares held indirectly by the parent company are held by KKR, the Company, and Walmart Group.

With this background, in order to accelerate the autonomous growth of the Rakuten Ecosystem in Japan and globally, while further increasing capital efficiency, we have determined that Walmart’s investment will contribute to the improvement of our corporate value and shareholder value. This is the background to our agreement to make the Third-Party Allotment to Walmart.

Judith McKenna, President and CEO of Walmart International, commented, “Around the world, we’re making strategic equity investments to enable Walmart to benefit from future growth in a rapidly changing global retail environment. We have known and worked with Rakuten for a long time, and in many ways their ambitious journey to develop a world-class e-Commerce ecosystem mirrors our own.”

Since 2010, the Rakuten Group has promoted the transition of the in-house official language into English, which is rare for a Japanese company, and has attracted diverse human resources, accelerating global innovation. Currently, the Rakuten Group has a global membership base of more than 1.5 billion people and an annual gross transaction value of 19 trillion yen. Through partnerships with globally popular sports teams, we are working to raise awareness as a global brand, and through brand integration, we are strengthening the communication of the “Rakuten” brand to the world. With the vision of continuing to be a “global innovation company,” we will bring together our intellect, creativity, and thoughts to create a society where people around the world can lead happy lives and pursue their dreams. We aim to continue to drive innovations that redefine expectations through a corporate culture that aims to get things done.

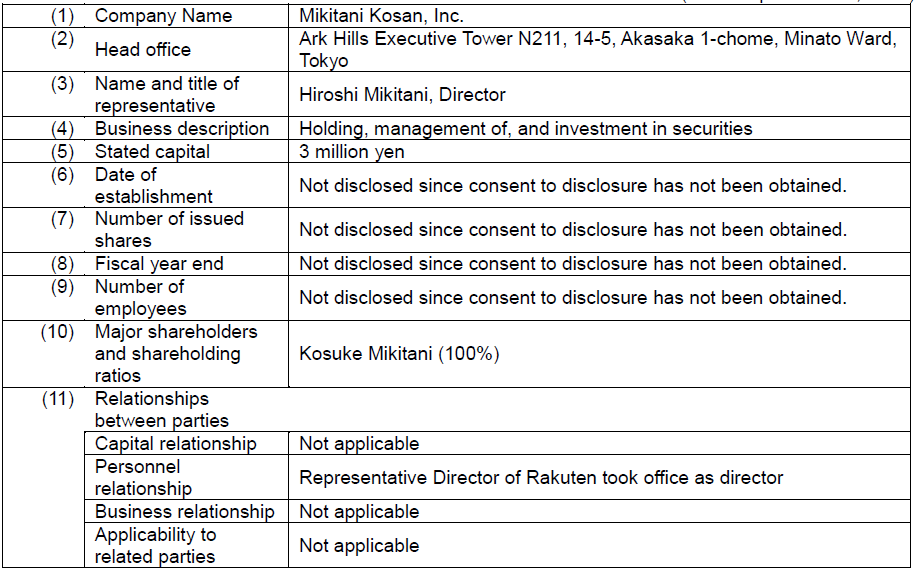

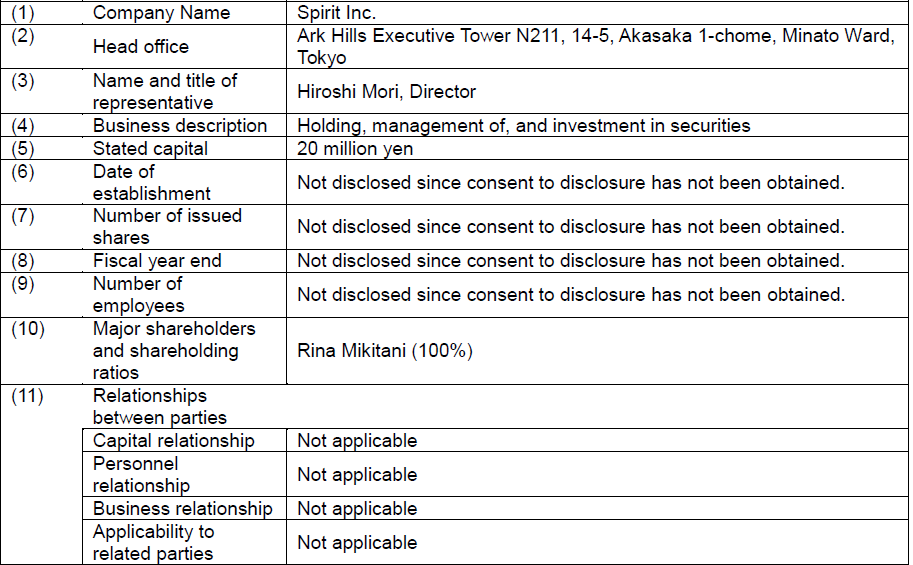

In addition, as described below, the background of the Third-Party Allotment is the recognition that building a strong financial base is indispensable for the Rakuten Group's future sustainable growth and in the process of its consideration, Hiroshi Mikitani, Chairman and CEO of Rakuten, (hereinafter “Mr. Mikitani”) indicated his intention to further demonstrate his deep commitment to Rakuten’s mid- to long-term growth and shareholder value by contributing to the financial base of the company through the Third-Party Allotment of shares to parties related to him, and in addition to his existing holding. Mikitani Kosan, Inc. (hereinafter referred to as “Mikitani Kosan”) and Spirit Inc. (hereinafter referred to as “Spirit”), to which the allotment is planned, are asset management companies of Mr. Mikitani’s family.

Hiroshi Mikitani, Rakuten Chairman and CEO commented, “These new investments in Rakuten indicate both high expectations for the growth and impact of the Rakuten Ecosystem with the mobile service at its core, as well as great potential for further collaboration with leading companies from the world’s three leading economies.

In addition to the potential collaboration with the Japan Post Holdings Group on logistics, mobile and FinTech, the new potential for partnering with Tencent opens up a broad portfolio of opportunities, from digital entertainment, including online games, to e-commerce. We’re also excited to have Walmart’s financial commitment as they continue to invest in the future of retail.

I am also personally very excited to increase my family’s financial stake in Rakuten’s future vision of growth and empowerment of our stakeholders around the world.”

In the rapidly changing Internet industry, we believe that a strong financial base is necessary for the Rakuten Group to continue to grow in the future. In making the Third-Party Allotment, we considered various aspects such as debt financings including bank loans and corporate bonds as methods of raising funds that contribute to improving corporate value. However, in view of the financial situation of the Company at this time, the Third-Party Allotment will be used. In addition to the appropriate financing, the ability to strengthen the relationship with the planned allottees, and the more effective use of the proceeds to be raised from the Third-Party Allotment, from the perspective of effective use of shares, we have determined that the combination of the disposal of treasury stock through the Third-Party Allotment and the Third-Party Allotment through the issuance of new shares is optimal at this time, rather than the method of public offering or rights offering.