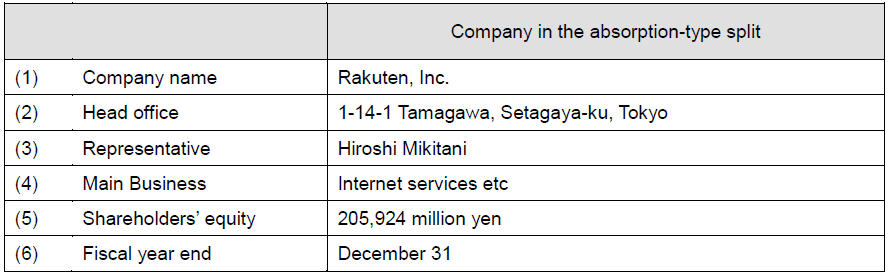

Rakuten, Inc. (hereafter the “Company”) announces that at a board of directors meeting held today, as announced in the press release "Announcement of Group Reorganization by a Corporate Split" dated August 6, 2018, and in “Announcement of Partial Revision of Group Reorganization” dated January 18, 2019, with respect to reorganization within the group (hereafter the “Group Reorganization”), we concluded an absorption-type merger agreement with Rakuten Direct, Inc. a wholly-owned subsidiary of the Company, and we decided to approve the conclusion of an absorption-type split agreement for Rakuten Mobile Network Inc., Rakuten Card Co., Ltd., and Spotlight Inc.

The Group Reorganization is an absorption-type merger for wholly-owned subsidiaries of the Company, and an absorption split that allows the Company's wholly owned subsidiaries to succeed business divisions and shares, so disclosure items and contents are partially omitted.

1.Purpose and background

Please refer to “1. Purpose and background” in the press release “Announcement of Group Reorganization by a Corporate Split” dated August 6, 2018.

(For reference)

The Rakuten Group’s core mission is to "contribute to society by creating value through innovation and entrepreneurship". We aim to continue to be a Global Innovation Company, not only provide highly satisfying services to users and business partners, but also supporting their growth, transforming and enriching society, and thereby maximizing corporate and shareholder value of the Group.

Currently, the Group does not limit its activities to e-commerce, but offers over 70 diverse services, from internet services such as travel, digital contents and communications, to FinTech (financial) services such as credit cards, banking, securities, insurance, and electronic money. These various services cover a wide range of life scenes and are organically linked together around membership, centering on Rakuten members, enhancing cross use activity by users within the Group’s services, and expanding our own unique Rakuten Ecosystem.

Recently, we have launched a partnership with FC Barcelona and accelerated global development including service brand integration. Our global membership base now exceeds 1.3 billion members. Global gross transaction value has surpassed 15 trillion yen and continues to grow. As the Group continues to drive interest from external stakeholders both in Japan and overseas, with the aim of further expanding the Rakuten Ecosystem, we have also decided to build new business portfolios by entering the MNO (Mobile Network Operator) business, by offering comprehensive logistics services in line with a vision for “One Delivery”, and by developing new services such as the C2C business and sharing economy services.

In the light of these developments, in order to realize further growth and development of the Rakuten Ecosystem and maximize corporate value, we have decided to implement a Group reorganization that will clarify accountability, further improve efficiency and allow for overall optimization of resources, by aiming to put in place a group structure that will enable flexible decision-making and business execution.

In order to offer services that maximize customer satisfaction, in each group company, we will aim to foster and revitalize entrepreneurship to an even higher level, pursue creative innovation to the full, as well as maximizing group synergies.

The Company will also continue to maintain its listing after the Group Reorganization, continuing to work to maximize corporate value by focusing on development of group wide global corporate strategy, strengthening governance and other key initiatives, and expanding our ecosystem centered upon internet services.

2.Method of the Group Reorganization

Please refer to “2. Method of Group Reorganization resolved at today’s Board of Directors meeting” in the press release “Announcement of Partial Revision of Group Reorganization” dated January 18, 2019.

(1)Reorganization of internet services business

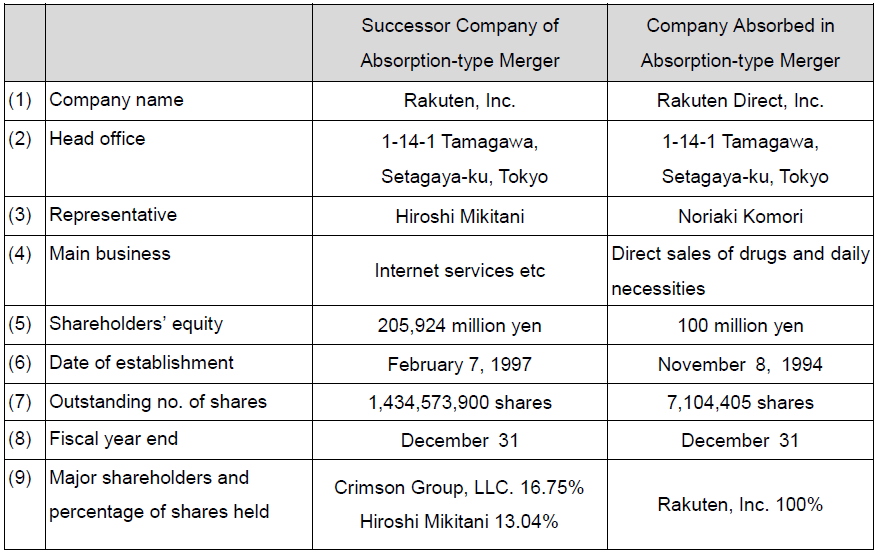

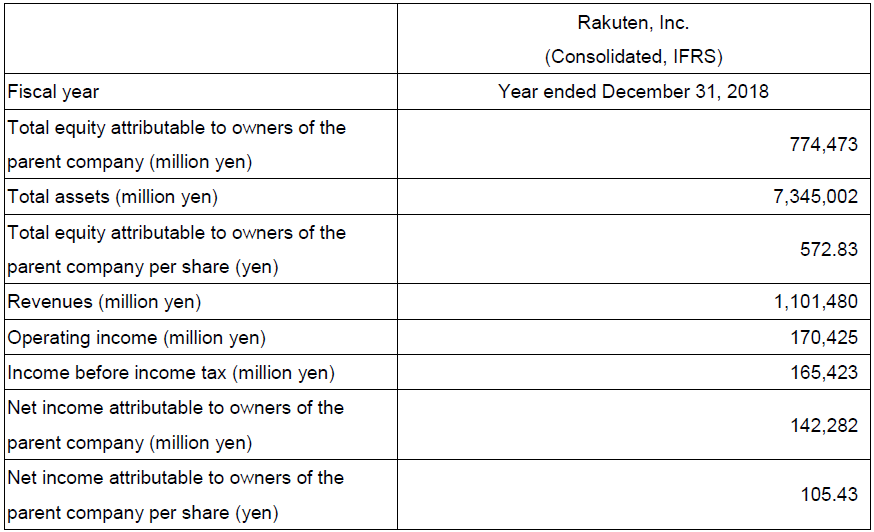

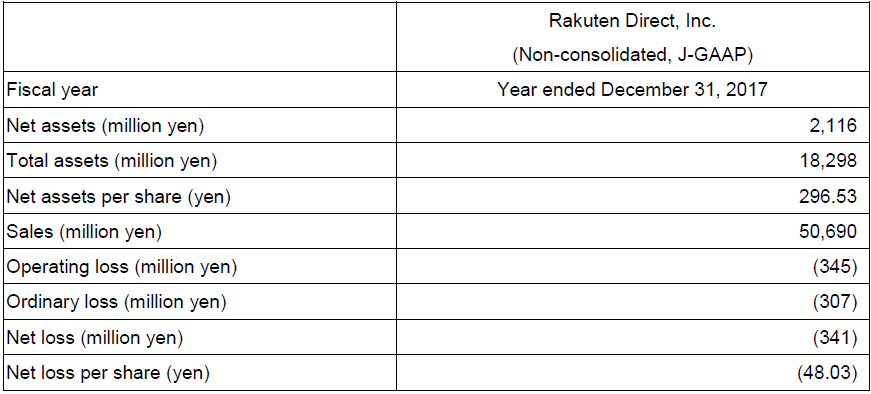

The Company is to be the succeeding company, and Rakuten Direct, Inc. as the company absorbed in the absorption-type merger (hereafter the “Absorption-type Merger”).

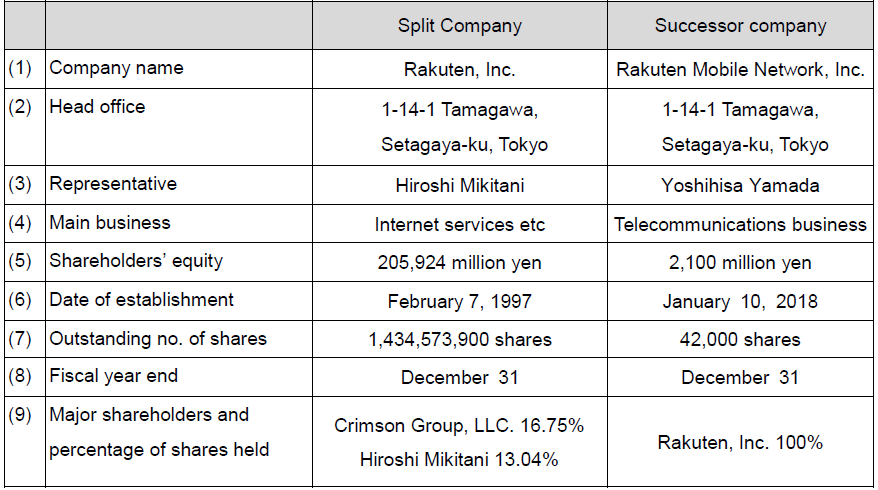

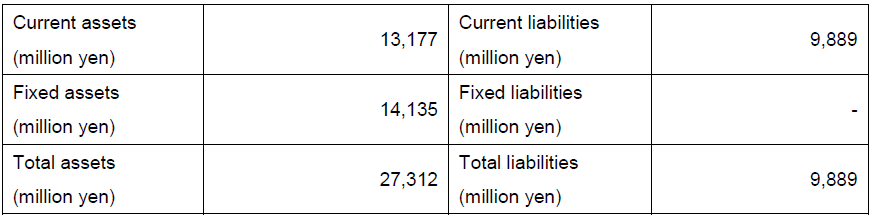

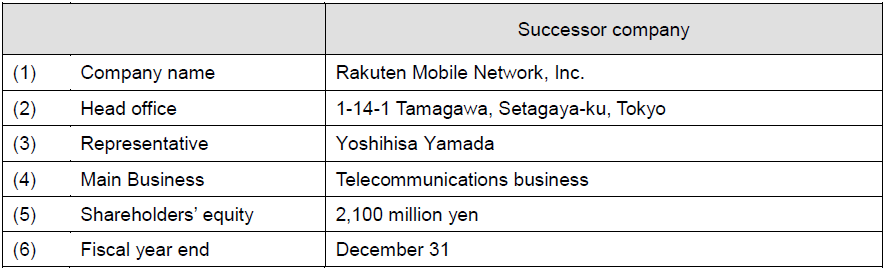

(2)Reorganization of mobile business

With the absorption-type split of the Company, the MVNO business of the Company and the shares etc. of Rakuten Communications Corp. will transfer to Rakuten Mobile Network Inc. (hereafter the “Absorption-type Split 1”).

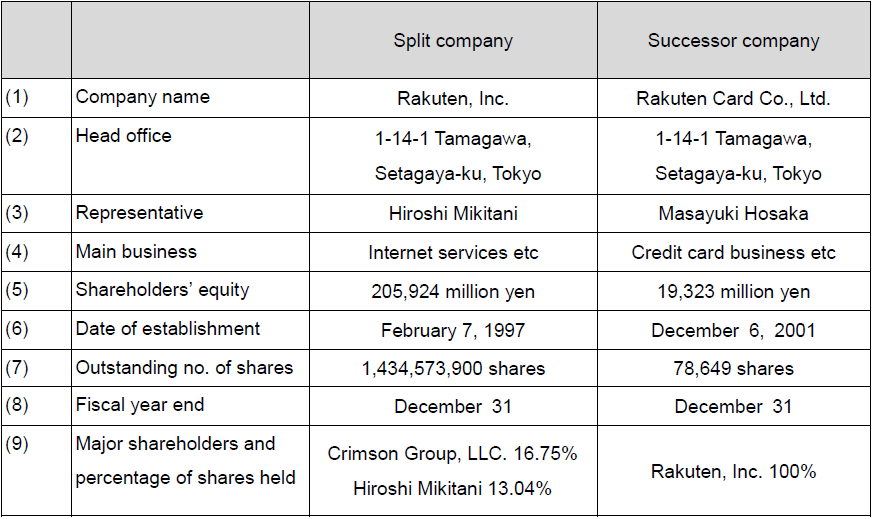

(3)Reorganization of FinTech business

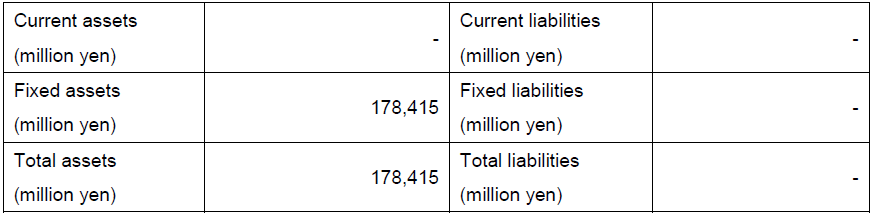

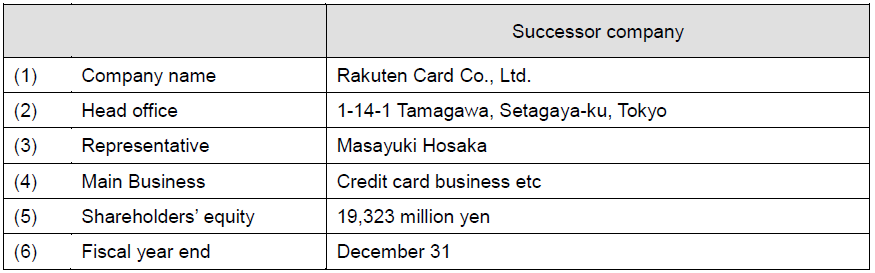

i. As a result of the absorption-type split with the Company as the split company, the shares etc of the Company's FinTech business, excluding the shares of Rakuten Card Co., Ltd. and Rakuten Edy, Inc., will transfer to Rakuten Card Co., Ltd., a wholly-owned subsidiary of the Company (hereafter the “Absorption-type Split 2”).

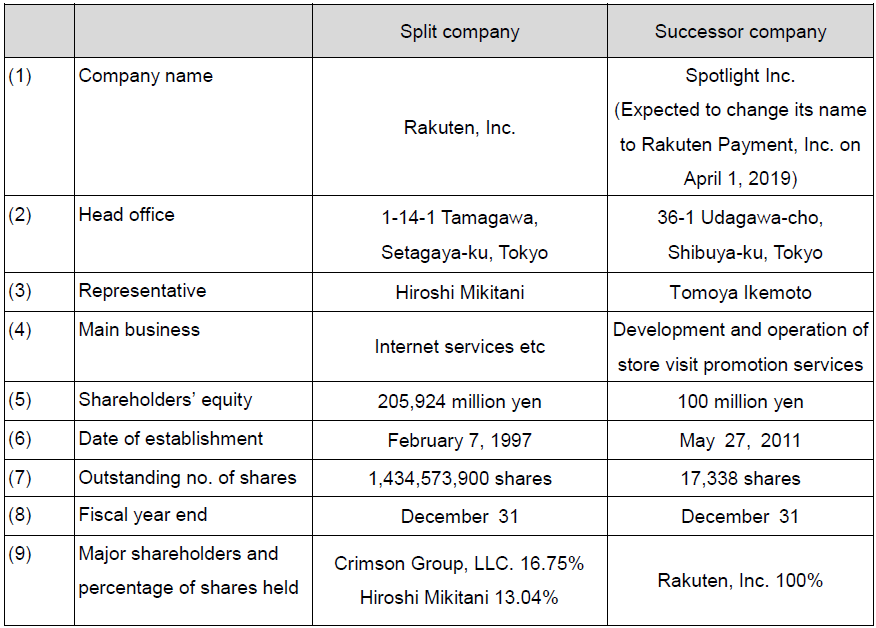

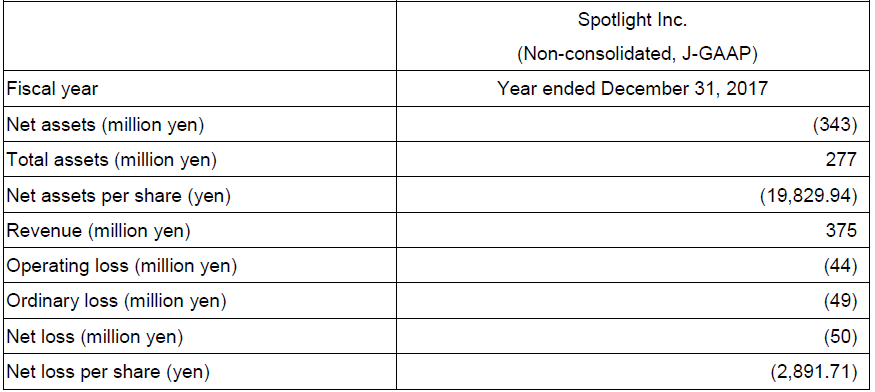

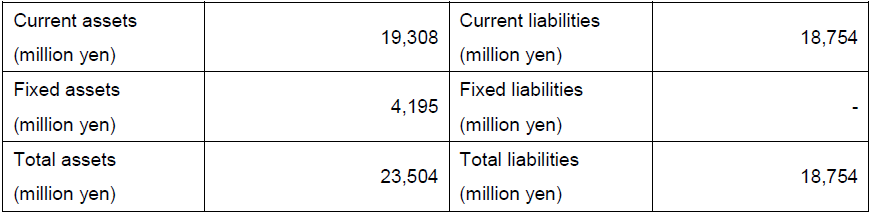

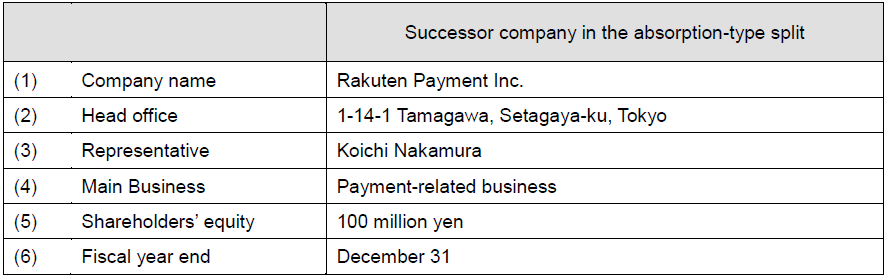

ii. As a result of the absorption-type split with the Company as the split company, the Company's payments-related businesses (Rakuten Pay business for real store payments, Point Partner business, Edy business etc.) and shares of Rakuten, Edy Inc., will transfer to Spotlight Inc., expected to change name to Rakuten Payment, Inc, on April 1, 2019) (hereafter “Absorption-type Split 3”).

iii. According to the absorption-type split with Rakuten Card Co., Ltd. as the split company, the shares of everybody’s bitcoin Inc. will transfer to Spotlight Inc. (hereafter “Absorption-type Split 4”). Since Absorption-type Split 4 is between wholly-owned subsidiaries of the Company, details are omitted.

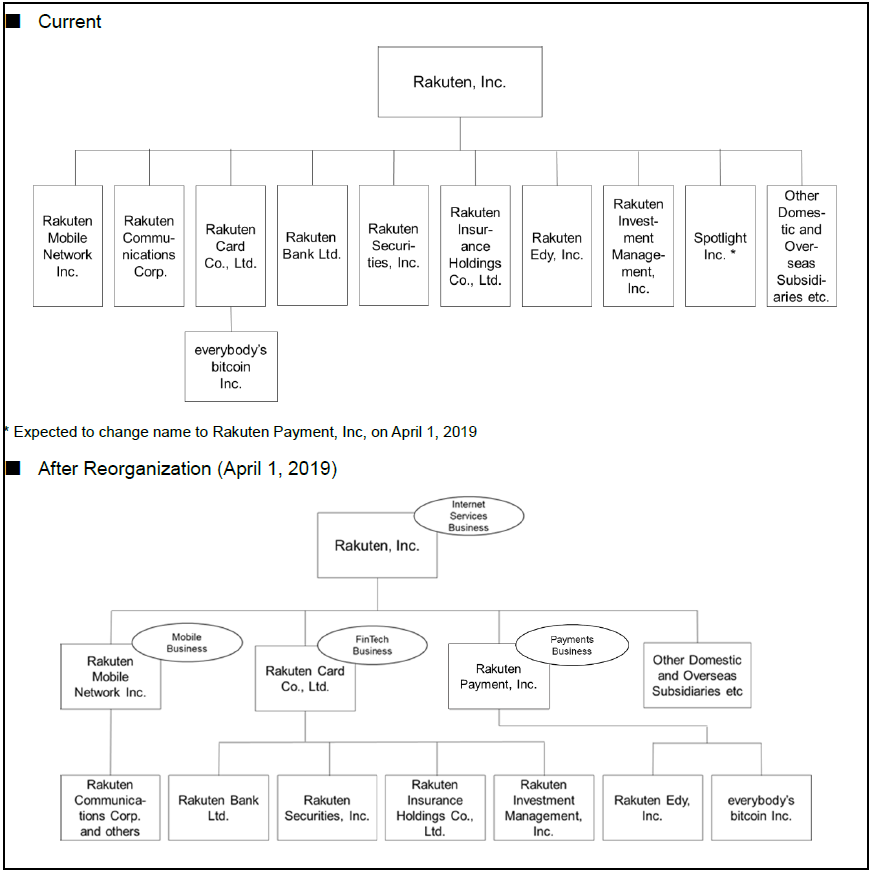

(For reference) Group Structure after the Group Reorganization